How the Oklahoma Turnpike Authority operates like a Soviet Regime

In a succinct presentation before the Oklahoma Senate Transportation Committee on September 27, 2022, Professor Tassie Hirschfeld illustrates the absurdity of the Oklahoma Turnpike Authority operations. Hirschfeld is a professor in anthropology who specializes in post-soviet autocratic countries and anti-corruption research.

Watch Hirschfeld explain how the Oklahoma Turnpike Authority operates more like a Soviet regime than a “State of Oklahoma” agency here:

Hirschfeld focuses on 3 policy failures: Cross-pledging, lack of independent oversight, and the perils that accompany OTA’s unlimited borrowing, taxing, and spending powers

Oklahoma Turnpike Authority Policy Failure #1

-

Cross-Pledging

- Loans are never repaid, only refinanced

- Banks get rich from fees

- Drivers get high tolls

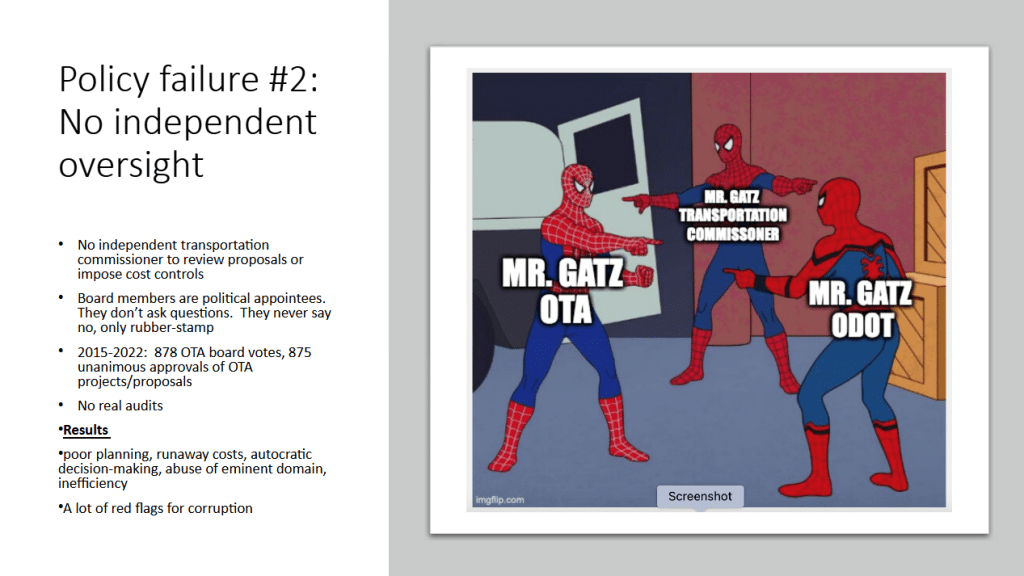

Oklahoma Turnpike Authority Policy Failure #2

-

No independent oversight

- Results in poor planning & runaway costs

- Autocratic decision-making

- Abuse of eminent domain

- Red flags for corruption

Oklahoma Turnpike Authority Policy Failure #3

-

No limits on OTA’s borrowing/spending/taxing

- OTA bonds are rated “investment grade” because there are no limits on toll increases

- Debt service has been the OTA’s largest expense since the 1990s and they have continually miscalculated how high their debt service payments will grow